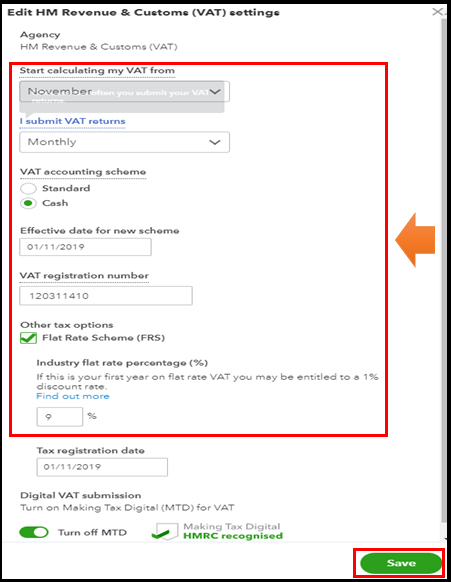

My client is late filing VAT returns and we need the first return to start from November 2019. How can I change this? I can only seem to adjust the month

Microsoft Dynamics GP: Group VAT filing for multiple companies with VAT 100 Return - Microsoft Dynamics GP Community

The VAT Return. Session Objectives 1.Correctly extract VAT information from financial records. 2.Correctly prepare VAT accounts incorporating adjustments. - ppt download

Free Vector | Tax payment deadline abstract concept vector illustration. tax planning and preparation, vat payment deadline reminder, fiscal year calendar, estimated refund and return date abstract metaphor.

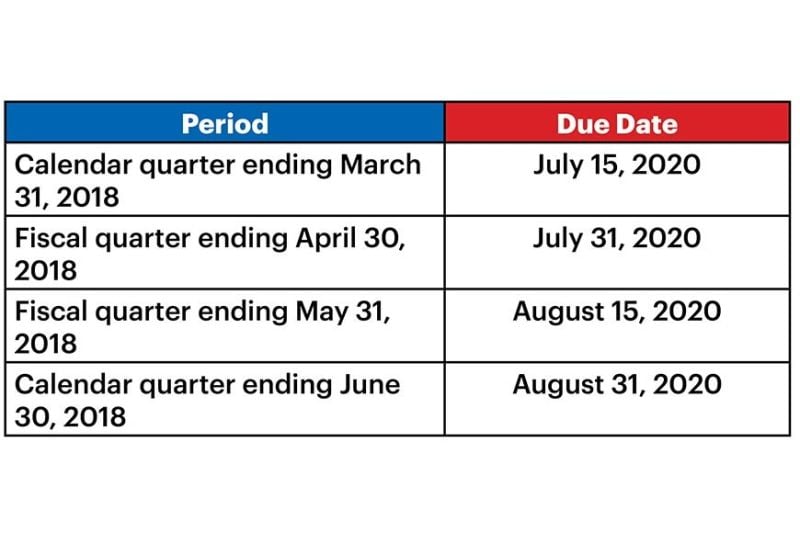

VAT return and intra community sales listing : extended filing due dates for the summer period | News PwC BE

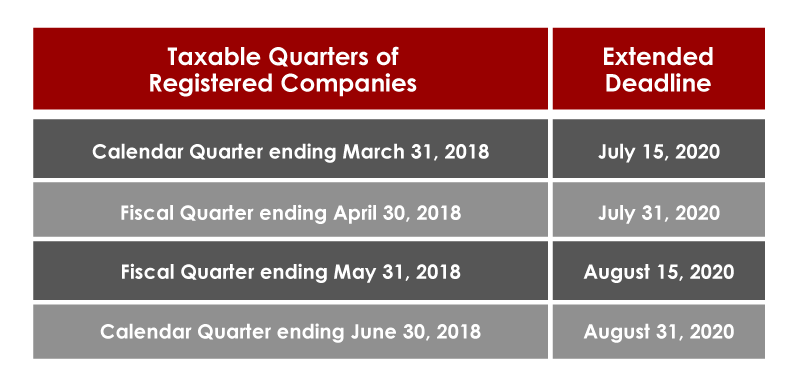

Further extension on the deadline for filing of VAT refund claims; 90-day processing period suspended in areas still under ECQ or MECQ | Grant Thornton

![UK] Prepare your VAT return – Help Center UK] Prepare your VAT return – Help Center](https://d1hzvs60s6jsjg.cloudfront.net/IMAGES-1/360025763412/Journal_entry_.png)